The Problem.

The Previous Process Was Sending Money Down The Drain

Water mitigation can be one of the most difficult processes when it comes to resolving a policyholder’s claim because of the numerous variables involved in the restoration process. One large carrier knew that they were potentially losing money on their specific water mitigation process because of the confusion around timing required for milestone events.

They needed help getting a handle on their process so they could be more efficient with their time and costs. That’s when they invited Symbility to help.

Our Response.

Plugging the Hole

While water damage restoration can be a pain to plan for, it doesn’t need to be.

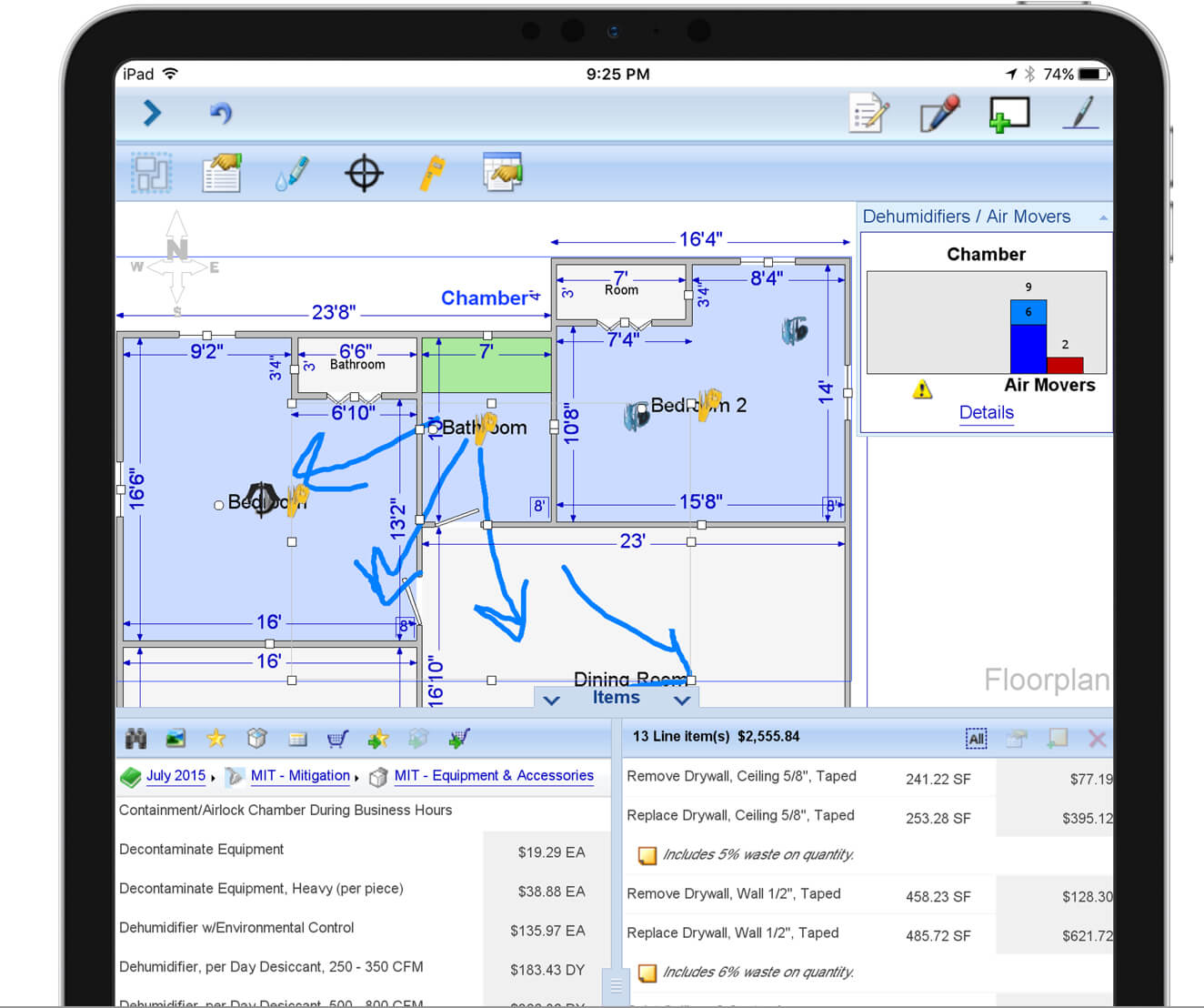

Working directly with the carrier and their partners, Symbility’s Mobile Claims Water Mitigation module was implemented to guide them through the creation of drying plans, event goal outcomes, and to help estimate associated costs directly through the platform. Symbility’s Water Mitigation module enables contractors and restoration professionals to capture water mitigation data onsite, while validating equipment usage and drying methodology to the industry standard Institute of Inspection Cleaning and Restoration Certification (“IICRC”) S500. This module offers contractors a new level of efficiency by creating estimates during the restoration process.

Using Symbiliy’s technology, the process became more efficient and cost-effective for everyone involved; carrier, contractors, and policyholders.

How We Did It.

Putting The Proper Pipes In Place

Before the rolling out the Water Mitigation module to this carrier’s water mitigation ecosystem, Symbility worked very closely with the carrier for a period of 3 months. In that time, our trained property experts examined the carrier's data on previous water damage claims, including the different types of water damage, drying times, associated restoration costs, and more. Once the carrier understood the potential impact the Water Mitigation module could have to the process, they were ready to roll out the technology and be confident they had enough data to use from past experiences to help make extremely accurate predictions for timing and costs for any new claims they would receive.

Turning The Tap On

Because water damage can be so invasive and take on many levels of damage, it’s important for carriers to start intervention as soon as possible. By initializing Symbility’s Water Mitigation module right when a policyholder calls in for FNOL, the software goes to work automatically allocating resources towards the claims based on the initial information collected. Symbility’s Water Mitigation module allocates internal resources automatically on a capacity basis and assigns a restoration contractor all in the same transaction.

The software goes to work automatically allocating resources towards the claims based on the initial information collected.

The Right Flow

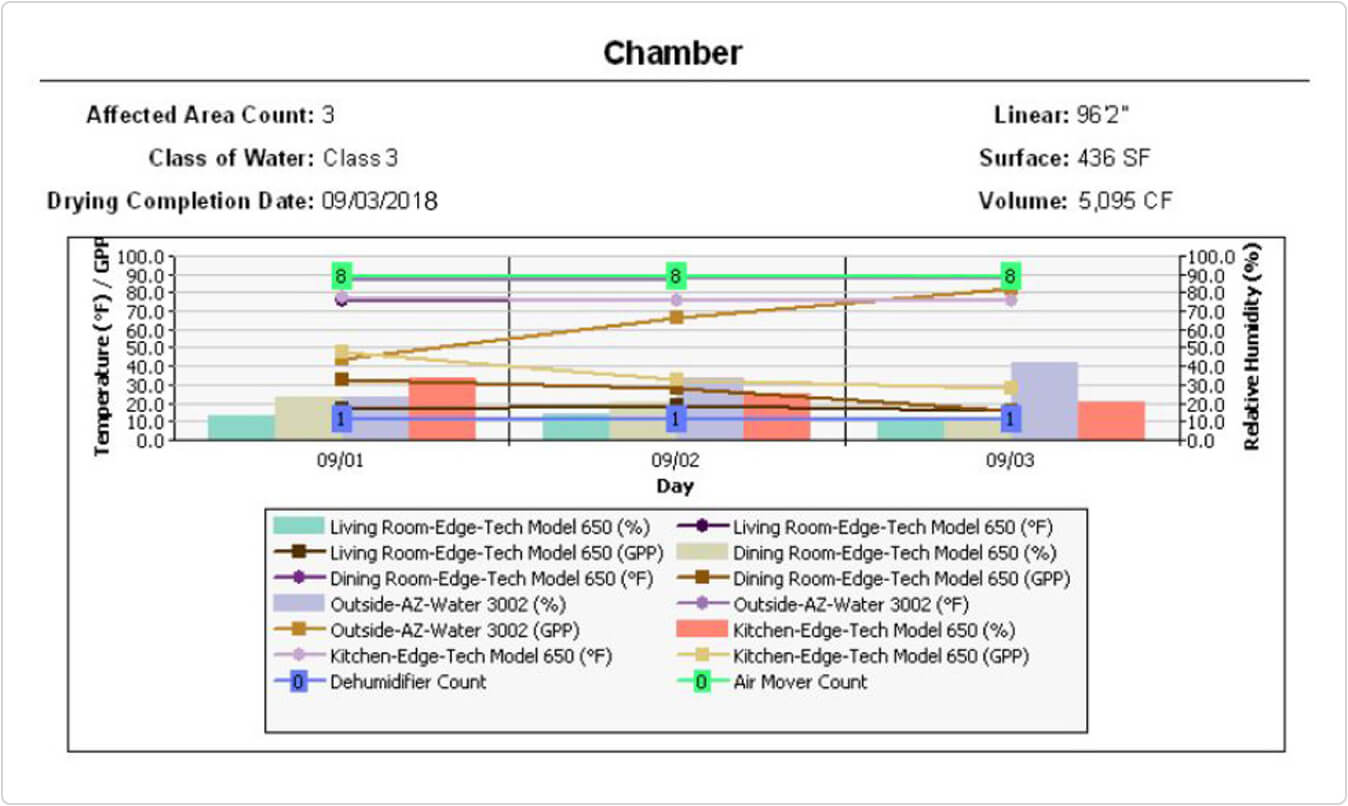

Once the claim has been started and initial inspections and estimations have been made, it’s time to put a full plan together that will help the policyholder get their property back to normal as quickly as possible. The Symbility Water Mitigation module was able to help the carrier put together that plan for the drying and restoration of the home.

The carrier was able to create a drying plan based on information gathered at the home combined with the aggregated data from previous incidents in the system to plan out accurate goal and check-in dates. Once the drying of the home was complete, the carrier was then able to start on repairs while also tracking costs through a restoration schedule that is built directly into Symbility’s estimating platform.

Results. Vastly Improved Drainage

Thanks to the time put in ahead of rolling out Symbility’s Water Mitigation module, the carrier saw significant improvements to how they approached water damage claims in the first 3 pilot months of the program. Some of these improvements included:

- Overall lifecycle reduction of 2.3 weeks for full reinstatement of claims involving drying through the Improved definition of loss right at FNOL, the ability to share data and collaborate with teammates through the Symbility system, and reducing the number of check-in visits through the drying phase.

- An average reduction of 2.1 visits per claim thanks to accurate estimates of drying times predicted through the system

- An increased opportunity for indemnity control through complimentary initiatives such as AA management. And,

- Greater customer satisfaction with the process as highlighted by a 65% reduction in complaints related to drying.

2.3 Weeks

Lifecycle Reduction

2.1 Visits / Claim

Reduction

Indemnity Control

Opportunity Increase

65%

Complaint Reduction